You are not GST ready until you prepare your organisation for ZERO LOSS Input Tax Credit (ITC) under GST. As per the last GST Council meeting, ITC will be limited only to those invoices uploaded by the sellers. GSTR 2A which contains invoices uploaded by your suppliers from July 2017 is also available for download. It’s a good time to start matching them before the auditor or GSTN flags mismatches for you.

GST Audit by a CA or Cost Accountant is mandatory for assesses having more than Rs. 2 Crore Turnover. The Annual Return with GST Audit Report needs to be filed by 31st Dec 2018 for FY 2017-18. Reconciliation of outward supply and inward supply with financial statements and matching with GSTR 2A will be essential for all assesses.

The Goods and Services Tax (GST) Council recently approved a single monthly return with an aim to boost collections and compliance. The new system is scheduled to be implemented in next six months

The new return filing process would be introduced in three phases:

Phase 1: First six months

• The current process of filing GSTR-3B and GSTR-1 will continue for the first six months.

• Software for the new system will be developed during this phase.

Phase 2: Next six months

• A single-monthly system of filing returns will be introduced for all taxpayers, except persons with nil liability and composition dealers. They will be filing quarterly returns.

• A uni-directional system of uploading details of invoices by the supplier will be implemented. Recipients will get credit on the basis of these invoices.

• For the first six months of the new system, a facility to avail provisional credit by the recipient will be available.

• Suppliers will be uploading details of invoices and recipients will follow up with the supplier in case of any gap in the uploaded details.

• Recipients will try and reduce mismatch through follow up only. No mechanism will be in place for the recipients to upload any invoice.

Phase 3: After 1 year

• The new system of return filing will be fully implemented with no facility of provisional credit. Credit will be available on the basis of details of invoices uploaded by the supplier only.

• If tax liability on uploaded invoices is not discharged by the supplier but the credit is availed by the recipient, the government would first recover the same from the supplier. However, the government would retain the power to recover the tax from the recipient also.

You can either wait for your Auditor or the GSTN to show you mispatched invoices and disallow Input Credit which is rightfully yours or then start invoice matching today

How can Tally.ERP 9 help you get full ITC ?

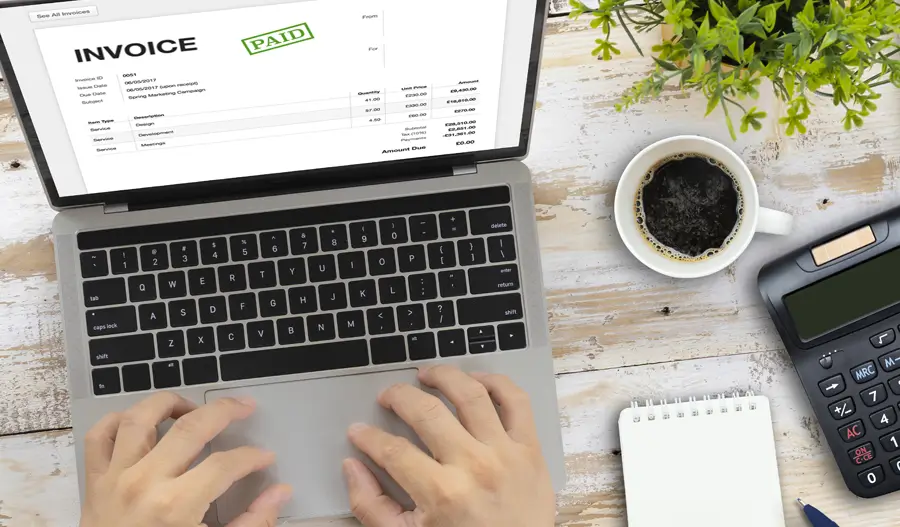

What is the Invoice Matching?

Sale of One Person will become purchase of another person. Hence the supplier of the Goods while doing the transaction of Supply of Goods & services to the recipient has to declare his all supplies in GSTR1.In simple words, Supplier Details in GSTR1 Details matches with the GSTR2A/GSTR2 of the Recipient and then only the Recipient will be eligible for the Input Tax Credit.

What is the purpose of introducing the Invoice Matching Concept?

The main motto to bring this Invoice Matching Model is listed below

1. To avoid Tax Evasion on account of false Invoices

2. To ensure input tax credit is transferred between states.

3. To Bring Discipline among the tax Payer himself through cross verification and auto-populated returns mechanism by GST Portal.

4. It will assist the taxpayer to get the List of Default Suppliers who have not filed their returns or is not uploading the Invoices religiously. This will enable them to deal with the genuine & compliances parties.

5. It will help them at the time of audit and assessment.

6. ITC will be availed only to the extent of Invoice Matching. Hence this will be a real-time flow and monthly affair where the parties will upload the Invoices and the counterparty will accept.

7. Technology will be great demand as Invoice Matching affair in case of huge Volume needs a robust software.

What are the Consequences of Mismatch of Invoices?

1. Loss of Working Capital

More Working Capital required to manage the Tax payments if all unmatched Invoices are not rectified and corrected in the following months then the receiver will avail the credit else it will be disallowed which may lead to cash loss to the recipients of goods.

2. Undue or Excess ITC Claimed by Recipients.

Section 42(10) deals where the recipient avails the excess ITC or undue ITC, then in such a case the Recipients shall pay the interest on such undue or excess ITC took at such rate not exceeding @24%p.a or such rate as may be specified by the appropriate authority.

3. Undue or Excess Reduction of Output Tax Liability by Supplier.

Section 43(10) deals where the supplier makes the undue or excess reduction of output tax liability, then in such a case the Supplier shall pay the interest on such undue or excess reduction at such rate not exceeding @24%p.a or such rate as may be specified by the appropriate authority.

4. Avails credit on Accrual basis and does not pay the Invoice

if the registered person avails credit on accrual basis and does not pay the invoice value to his supplier of goods or services or both within 180 days from the date of issue of the invoice, he would be required add the ineligible credit so availed, as his output tax liability and ITC will be reversed.

5. Default in the Payment of Tax

As per 27th Council Meeting -In case a supplier has defaulted in payment of tax above a threshold amount, such a supplier will not be allowed to upload invoices and thus will not be allowed to avail any ITC. This has been introduced to avoid and to control misuse of the ITC facility.

What are the components to be matched for the GSTR2 reconciliation for Invoice Matching?

The following details must be matched in the GSTN portal while filing Form GST-2:

• GSTN of the supplier

• GSTN of the recipient

• Invoice/Debit Note number

• Invoice/Debit Note date

• Taxable value

• Tax amount

What are the rules of the Set-off?

What is the last date for availing the ITC for FY 2017-18 ?

Till the time the due date for the filing of the GSTR-3 is being not prescribed then ITC of invoice pertaining to FY 17-18 can even be claimed after the month of September and can be claimed up to the notified due date of GSTR-3 of FY 18-19 or annual return of FY 17-18 whichever is earlier

What the Possible reasons for Mismatch of the Invoices and what action is to be taken

1 The supplier has not filed the GSTR1 till date, but the Recipient has shown in his purchases.

Recipient Should Check his return status from Search Tax Payer whether the party has filed the return or not. Take the Provisional Credit and Ask the Supplier to approve the same in the GSTR-1A

2. Purchase recorded in Accounts by the Recipient but missing in GSTR2A.

The Supplier did not mention in the GSTR1 communicate with your supplier

3. Purchase appearing in GSTR-2A but missing in accounts. Supplier mentioned the wrong GSTIN in GSTR-1

Communicate with the supplier to make the correction

4. Purchase appearing in GSTR-2A and accounts but the amount does not match. Supplier mentioned the wrong amount in GSTR-1.

The recipient to Modify it with correct amounts as per your purchase ledger. Ask the supplier to approve the same in GSTR-1A.

5. Purchase recorded in GSTR-2A but missing in accounts. Recipient missed making the entry in purchase ledger.

The recipient should Add the invoice in accounts

6. Purchase recorded in purchase ledger but missing in GSTR-2A. Recipient made an error in accounts, eg. wrong GSTIN entered.

The recipient should Modify/Delete the invoice in accounts.

How will Tally.ERP help you identify mismatched Invoices?

Tally.ERP 9 will match invoices uploaded by your supplier and automatically highlight mismatches as follows.

(Software@Work has developed an add-on utility that will automatically send emails to suppliers who have uploaded dispatched invoices thereby saving considerable time and effort in ensuring complete matching )

Reports available in Tally. ERP 9 and how they help

1. Partially Mismatch Report – Under the Tally GSTR2 Reconciliation, it shows Partially Mismatch Report

This will show that some of the Transactions Fields are not matching with the Transactions as per the Books of Accounts. Invoice To Be Booked As Per The Invoice So That The Decimal Places Issue Of The Tax Ledger Will Not Encounter And No Mismatch Will Happen Mentioning The Proper GSTN No, Suppliers Invoice No, Date And Tax Amount.

2. Available Only in Books Under the Tally GSTR2 Reconciliation, it displays transaction which is available only in Tally ERP. 9.

This will show that some of the Transactions are available only in the Books of Accounts and not in the GSTR Portal. Hence the recipient will start informing to the Supplier about the same as why it has not been uploaded in their GSTR1 and after confirming the same the Recipient can mark as “New” while exporting the same.

3. Matched but Status Not Updated/Status Updated Displays the Transaction will get matched but the status is not got updated or already updated

This will help the Tax Payer select the transactions and manually set the Status as Accepted, Accepted with Ineligible ITC, Modified, Pending , or Rejected

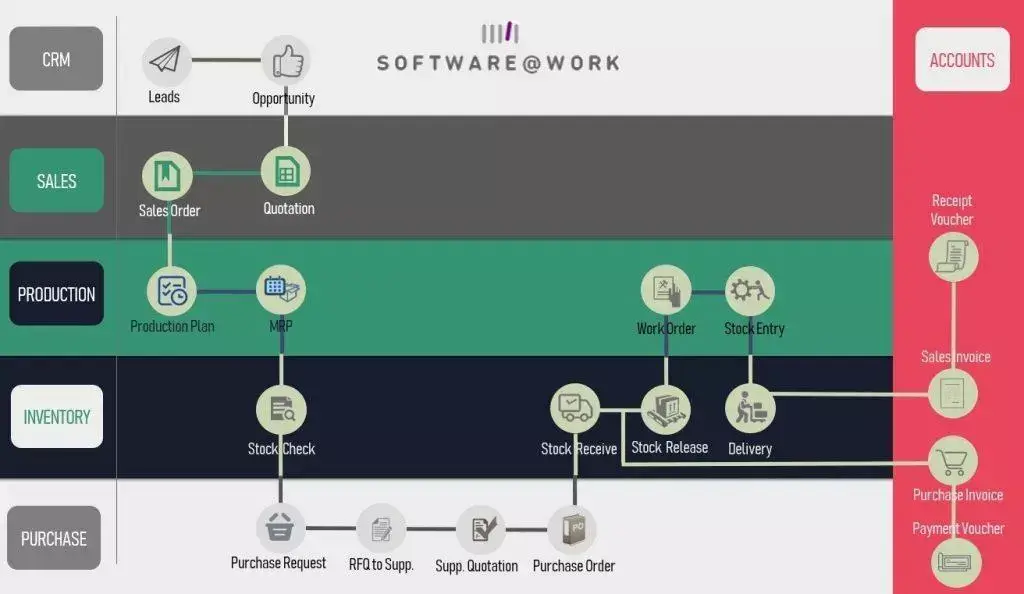

Software@Work conducts regular workshops, webinars and training to enable our clients get updated with what’s new in the GST and Tally.ERP 9.

Register at www.sawindia.com/gst or call us on 02246124444 / 02242482222 for any assistance.