The first part of this blog was published in December 2016 (https://sawindia.com/gst-taxation-meets-technology/). A lot has happened since and it’s a good time to see where we are headed.

Undoubtedly GST will be the biggest tax reform in India, not due to the enormity of the tax changes but also due to the extent of the technology impact on the way business is done and will be done in the future.

As of March 2018, there have been over 1 Crore businesses have registered under GST. It is possible that a large part of these i.e 2 to 3 million businesses could be looking for software to automate their businesses. This is no small number by any standards.

The GST Council in its meeting on 4th May 2018 has announced a simplified GST return process. While we have all had a bumpy ride, GST still holds the promise of being a historical tax change not just due to the extent of change but due to one single aspect : API . API is the acronym for Application Programming Interface, which is a software intermediary that allows two applications to talk to each other.

This is the first time in India that a taxation system has been designed ground up based on technology.

Traditionally, tax payers have had to create and file ‘Returns’ as part of compliance. This required time and skill. With GSTN requiring the upload of transactions, theoretically there should be virtually no need to file a Return since all the data required to file the Return is already with the Government. This could change the compliance landscape radically.

Lets look at how this GST journey is unfolding . One can simplistically visualise 3 phases to the GST rollout :

Phase 1 – The uphill climb (from 1st July 2017) . In this phase, a complex GST Return process was announced. Due to no readiness of IT systems both at GSTN and Tax-payer end the system could not be rolled out

Phase 2 – The simplification phase. We are currently in this phase of the GST rollout and simplifications have been announced in the above GST Council meet, namely – Single monthly Return, Unidirectional flow of invoices, Simple Return design and easy IT interface etc . It’s not too often that any Government has spend this much effort on simplification of processes for the tax payer.

The Government has recognised that GST compliance is IT dependant and that many small businesses are not yet ready to manage even the above simplified process.

Accordingly the GSTN has taken a bold step in creating an ecosystem to offer accounting and billing software for small and medium taxpayers for free !

This heralds a major phase in the process of easing the life of the tax payer by reducing the time and cost of compliance. An initiative like this has never been seen before. This eco-system will not only offer software for small & medium businesses but will also take care of hand-holding and support for usage of the software.

The ecosystem envisaged and being created by the GSTN aims at offering software to handle the following activities / processes :

- Invoicing

- Financial book keeping

- GST compliance & Return generation

- Purchases & inventory

- Creation of mismatch reporting for GST

Certain value added services like Budgets, Sales / Profit analysis, Purchase planning, Graphs, TDS etc could be added as value added features which could be charged extra.

Once the above software products are available, the phase of automation will begin for thousands of small and medium businesses

Phase 3 – Good days ahead. Once tax payers have access to software, compliance will

become easy . More businesses would become tax compliant . At this time, the Government may increase compliance or reporting requirements eg. Reverse charge on purchases from Unregistered Dealers . However, It would not be a challenge for tax payers to comply with changing compliance requirements , since a lot of the compliance would be software driven and almost completely automated.

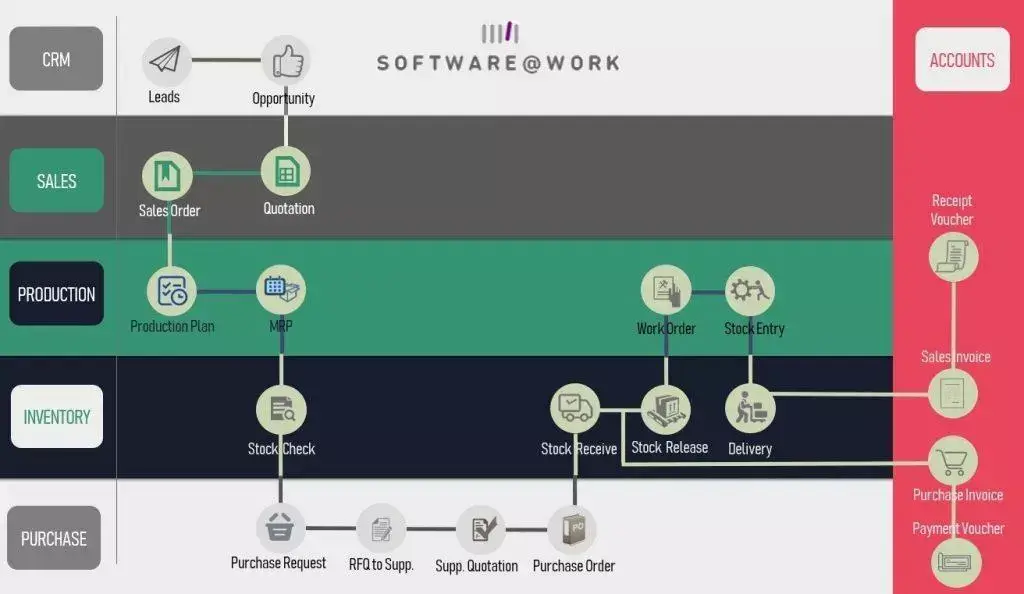

The benefits of an API driven GST network would come into play and create a highly automated business community. This will transform the way business is done . For example ,

- A physical copy of the E Way bill is not required and can be carried digitally

- Digitally signed invoices would be acceptable under the GST law

- Accounting & ERP systems are directly interchanging data with the GSTN for compliance

- Businesses would probably have automated matching systems to ensure no mis-matches take place across supply chains even before matching happens on the GST network.

- Electronic data interchange would be the norm and business transactions would be interchanged in real-time basis (like the banking systems NEFT / RTGS / UPI systems)

- Duplication of data entry but multiple entities would be eliminated. For example, a Purchase Order from a customer with 100 items would automatically become a Sales Order for the Supplier without the requirement to re-input all the items.

- Reconciliation of Customer/Vendor accounts would be a thing of the past since they would be automated

- Digital payments will become the norm. ERP/Accounting software would be directly linked to banking systems for automated Bank Reconciliations

- Supply chains would become more efficient and Stock and Sale visibility would be easy to manage for OEM/Principal Manufacturers

- It is likely that the Govt. would automate other taxations systems like Direct Taxes – specially TDS.

The benefits and vision of an automated taxation system could soon be fully realised and would be like never seen anywhere in the world . The increase in efficiency and reduction of manpower would provide immense benefits to businesses that automate.

It’s time to get the right software and take your business to the next level. We at SoftwareHunt can help your make the right moves at this critical juncture. Call 02233494500 for a free consultation or view our GST offerings on https://sawindia.com/gst-training-mumbai/