The GST Council has approved B2B E-invoicing in a phased manner from Jan 2020. From 1st April 2020, this is mandatory for companies with a turnover exceeding Rs 100 Crore and optional for those below Rs 100 Crore.

The GST Council had approved B2B E-invoicing in a phased manner from Jan 2020. As per their latest notification, the limit is reduced to Rs.10Cr w.e.f 01/10/2022 (i.e) for any registered Business with aggregate turnover exceeding Rs.10 Crores in any FY 2017-18 onwards has to issue E-invoice from 1st October 2022

We have been writing about this since 2016 (on www.sawindia.com/blog) where we mentioned that with GST the transaction will be the return. This could soon be a reality.

The journey continues and now we are on the threshold of another major step – E-Invoicing. We throw light on this in an FAQ format for easy reading.

Why is E-Invoicing a game changer?

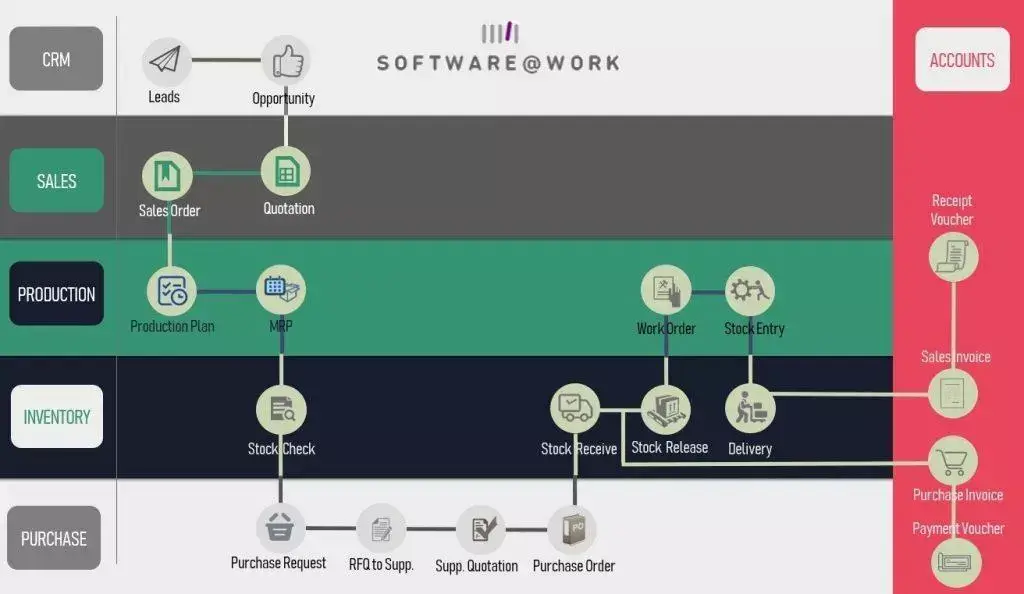

While E-Invoicing seems to be another step in the GST journey, we see it more as an important technology related milestone. EDI – Electronic Data Interchange , a term used since the 70’s is the electronic interchange of business information using a standardised format. It is a process where one company can send information to another electronically rather than with paper. More importantly, this information can be used by the receiving company to save time and effort on re-entry of this information into its own systems. Eg. A Sales Invoice with 100’s of items needs to be re-entered by the buyer into their own software as a Purchase Bill. The GSTN has created a standard structure, where the E-invoices created by one software can be read by another software , eliminating re-entry of data. In our opinion this step has huge implications and will lead to the start of EDI being used on a mass scale in India for this first time. It will also kickstart a process where businesses will see the benefits of technology in enhancing productivity by interchange of data

What are the productivity benefits of E-Invoicing ?

GST Reporting will become a by-product of E-Invoicing

To understand the benefits of e-Invoicing lets look at how we currently operate and how this will change . Currently, after Invoicing, there is duplication of effort with data required to be uploaded again in different formats for EWay bill generation and GSTR 1 Return filing.

| Activity | Pre E-Invoicing | Post E-Invoicing |

| Create Invoice | Required | Required |

| Create E-way bill | Required | Eliminated |

| File GTR 1 – Upload Invoice to GST Portal / ANX-1 | Required | Eliminated |

| Data re-input by Buyer as a GRN / Purchase Bill | Required | Eliminated |

As we see above, E-Invoicing will eliminate additional efforts of re-input & upload of data into the GST Portal and the E-Way Bill portal. Soon enough, different software applications will read and re-use data, saving time and reducing errors.

Are there any benefits of E-Invoicing for the buyer ?

Buyers will have an inbox to view all valid invoices and will immediately see valid invoices on their ANX 2 Return enabling them to be assured of Input Tax Credit (ITC). Additionally , the data would be available for re-use in preparation of the Good Receipt Note, Matching with PO and adding to inventory when the goods arrive. This will result in considerable time saving for the Buyer too.

How will the E-Invoice be generated ?

The E-Invoice will continue to be generated on your own billing / accounting software / ERP. Your software will then send this data to an Invoice Registration Portal (IRP), which will generate a unique Invoice Registration Number (IRN), digitally sign the e-invoice and also generate a QR code. Without an IRN, an invoice will not be a valid document.

The e-invoice can be registered on the GST portal thru multiple ways such as :

- Web based,

- b. API based,

- c. mobile app based,

- d. offline tool based and

- e. GSP based

How can one know whether an Invoice is valid ?

Once an e-invoice is generated, The GST Returns ANX 1 (the sellers sales) and ANX 2 (the buyers purchases for calculating ITC) will be updated. Hence a buyer will be able to see his valid purchases in the ANX 2 .

Additionally, the digitally signed e-invoice can be emailed to the buyer . The QR code on any invoice can also validated with an offline mobile app . The QR code will have the following info :

- GSTIN of supplier

- GSTIN of Recipient

- Invoice number as given by Supplier

- Date of generation of invoice

- Invoice value (taxable value and gross tax)

- Number of line items.

- HSN Code of main item (the line item having highest taxable value)

- Unique Invoice Reference Number (hash)

Can an E-Invoice has its own format and for viewing and printing?

Yes each business will be able to have their own / existing formats for viewing and printing e-invoices as long as the mandatory fields are present. It must be noted that the Invoice Registration Number (IRN) will be a new data field and will need to be retained in the systems of both seller and buyer.

Can an E-Invoice be partially or fully cancelled?

An E-Invoice can’t be partially cancelled. It has to be fully cancelled. Cancellation has to be done as per process defined under Accounting Standards.

The e-invoice mechanism enables invoices to be cancelled. This will have to be triggered through the IRP, if done within 24 hours. After 24 hours, the same will need to be done on the GST System.

Amendments to the e-invoice will be allowed on GST portal as per provisions of GST law. All amendments to the e-invoice will be done on GST portal only.

Need more into on E-Invoicing ? Check our the FAQ shared by the GSTN : https://www.gstn.org/e-invoice/doc/Updated-e-invoice-FAQs-v6.pdf

Software@Work has been offering affordable software solutions for 30 years and has helped 100s of clients ensure compliance for e-invoicing with TallyPrime. Connect with us for more details – [email protected] or call 7303030000 Check our Webinars & Workshops on https://sawindia.com/events

Check out the video intro on E-Invoicing released by GSTN